Local Strategy Outperforms National Templates

Our team knows how Harris, Fort Bend, Montgomery, Brazoria, and Galveston districts value SFR assets—and how to challenge them effectively.

SFR Investors

National vendors miss Houston's neighborhood-driven nuances. Rainbolt's local strategy consistently delivers deeper reductions—at scale.

Our team knows how Harris, Fort Bend, Montgomery, Brazoria, and Galveston districts value SFR assets—and how to challenge them effectively.

We evaluate neighborhood-level sales, rental trends, and appraisal district behavior to build stronger arguments for every property.

Whether you own 25 homes or 2,500, every property is analyzed, prioritized, and appealed with the same rigor.

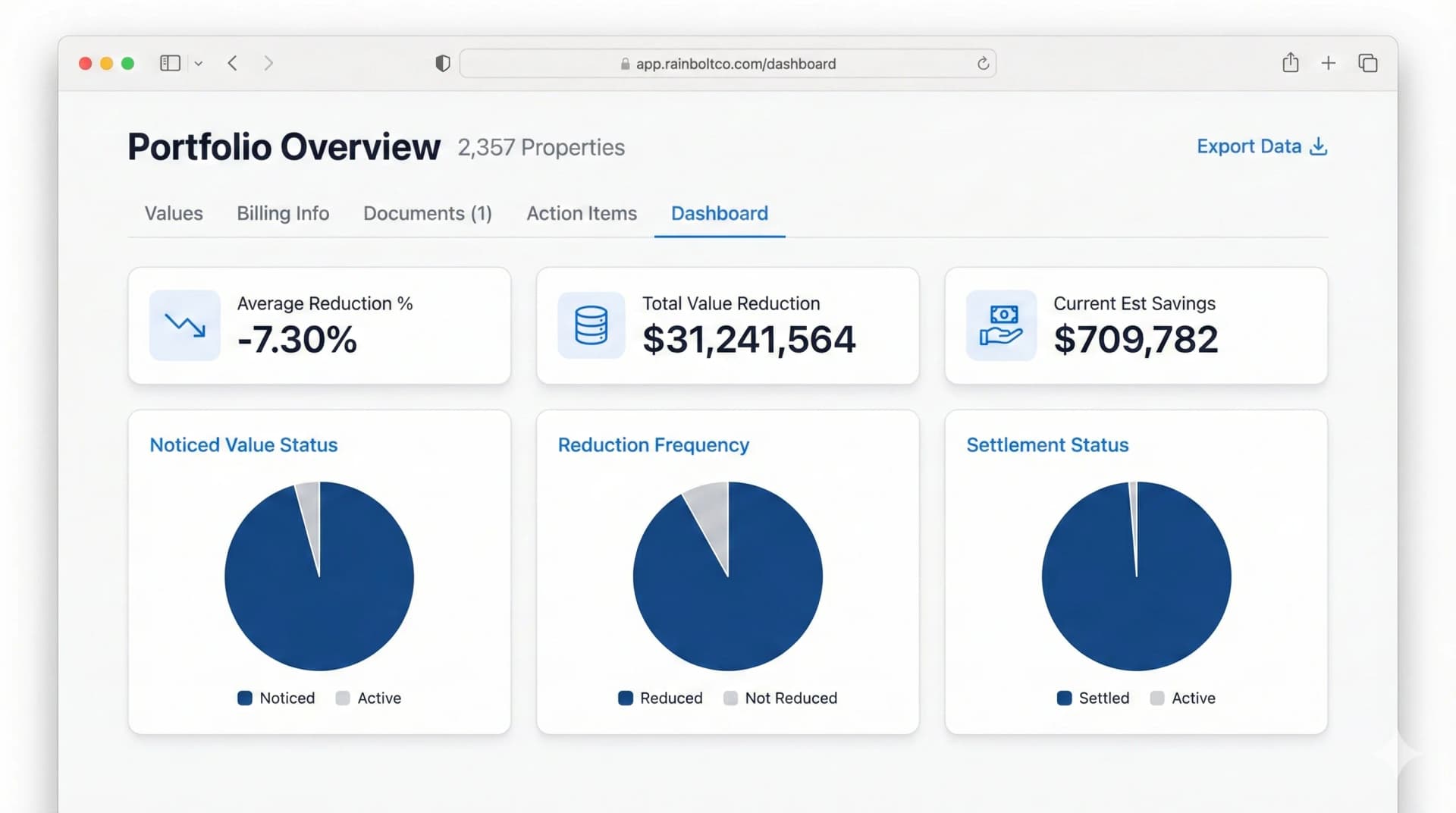

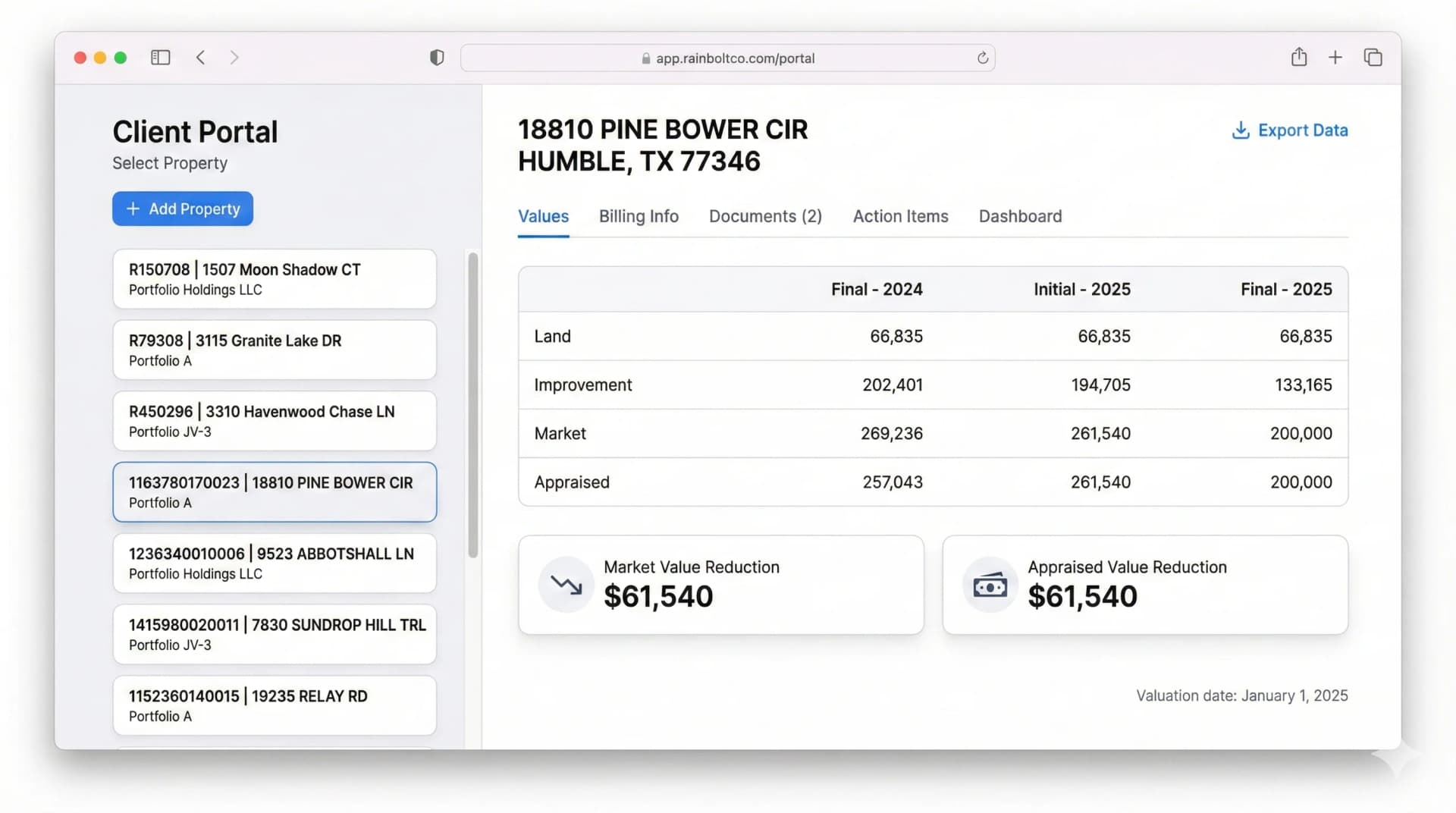

Real-time dashboards, portfolio-level reporting, and direct communication built for your workflow.

Real-time visibility into noticed values, reduction rates, settlement outcomes, and portfolio-wide savings.

Example investor dashboard view. Actual portfolio metrics vary.